Revised position limits for exchange traded currency derivatives

The moves are in line with the Budget announcement made by Finance Minister Arun Jaitley, where he called for deepening the currency derivative market. Currency derivatives are like any other derivative products that have no independent value.

At present, two forms of derivative products are available — futures and options. Futures trading can be conducted in four currencies — dollar, euro, pound and yen — while options trading can be done only in dollars.

The basic difference between futures and options lies in the obligations. If a futures contract gives a buyer or seller an obligation to buy or sell, then an options contract gives a buyer or seller the right, not obligation, to buy or sell.

The objective is to raise the open position limit, as sources said, there is stability in the market.

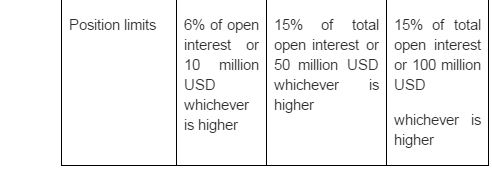

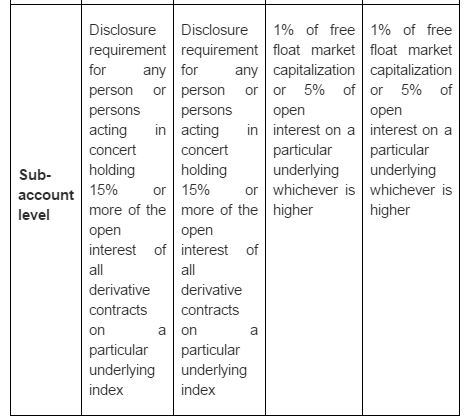

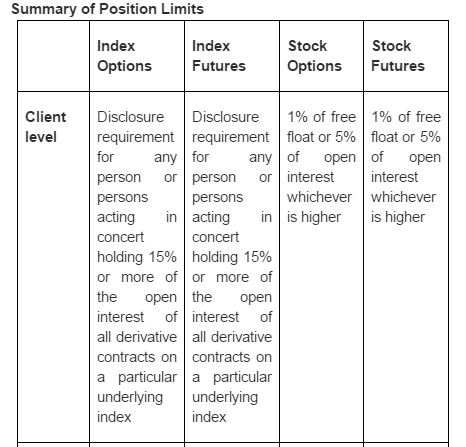

In order to curb extreme volatility, SEBI revised the position limits for exchange traded currency in consultation with the RBI in July last year and curtailed position limits and increased the margin requirements. The positions were reviewed in June and October this year. SEBI also plans to extend the trading in the currency derivative till7. Exchanges — BSE, NSE and MCX-SX — have been demanding extension of trading hours to facilitate market participants to adjust and alter their positions in line with currency movements in global markets.

Also, longer trading hours will help in controlling sharp volatility in currency markets abroad, such as Singapore, where domestic regulators have no control.

The currency derivative market got a boost in June this year when the RBI allowed foreign portfolio investors FPIs to hedge their investment in India.

- Kategori ikke fundet

This can be done by accessing the currency futures or exchange traded currency options market. FPIs include foreign institutional investors and qualified foreign investors. Earlier, such investors, wanting to hedge their equity positions, had to go abroad.

-- Revised Position Limits for Exchange Traded Currency Derivatives - Shares & Stock Notification & Circulars

The move is expected to boost forex inflow. Catalyst Multimedia Today's Paper Topics ePaper WealthCheck.

Regulators mull wider position limit, longer trading hours. Get more of your favourite news delivered to your inbox.

Please Wait while comments are loading This article is closed for comments. Please Email the Editor.

Sensex ends marginally lower; Tata Motors, ONGC stocks skid. DATA BANK Cross Currency Rate. MOST POPULAR MOST COMMENTED. Equity Intelligence gets SEBI nod for alternate investment fund Sensex ends lower as crude oil falls to 7-month low Eris Life subscribed 3. LATEST NEWS Bahrain announces regulatory sandbox for fintech startups 53 min.

About Us Contacts Privacy Policy Archives Subscription RSS Feeds Site Map Brand Quest ePaper Social BL Club Mobile Group Sites: NEVER miss any latest news!