Sniper trading strategies

You can find a number of trading strategies called "Sniper" online, but today we will talk about the cognominal system on the indicators, as it is easy to use and, incredible as it may seem, is unique, because it is built on its own formulas and does not copy the pattern of other traders. Despite its age about 7 years , the Sniper strategy is still not without reason attracting the attention of speculators. Firstly, it is perfect for both intradayers and positioners.

Trade Forex Like a Sniper and Start Trading From Kill Zones

Secondly, the work does not impose any strict limitations on trading tools, although initially the algorithm was designed for the British pound. And thirdly, there are a few advisors on the basis of the system of indicators today.

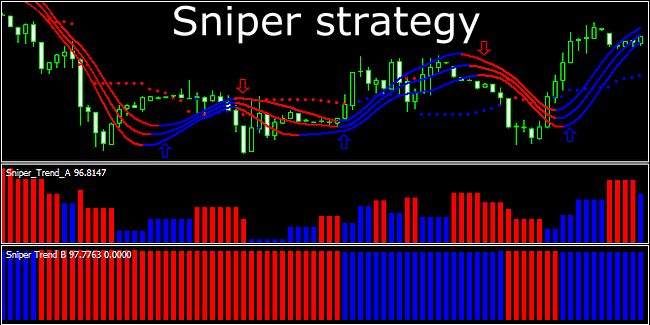

You can find several versions of this method online, with various additions, modifications, and even scripts, but the pattern for the base and concurrently the most reliable version will include a set of the following indicators:. To make deals to buy, several conditions must be met. Firstly, all moving averages must change the color to blue. Please note — the deal is made in a short time after the color change, this approach allows you to catch a trend reversal in the beginning, but if you enter the market after a long time after the reversal of the movings, there is a high probability to buy the high.

Secondly, both Sniper Trend histograms must also change the color to blue.

This is due to the calculation formula, which is built taking into account the extremes and in reality is not as simple as it may seem, so making deals by a color change in this case is not something primitive for lazy traders — in contrast, is a simplified representation of complex calculations. The figure below shows an example to buy the combination of signals will be completely the opposite for the deals to sell:.

As it can be seen, in this case Parabolic remained red, and the obligatory change of color was not mentioned above. Sniper strategy and some of the nuances associated with the placement of stops and take-profits.

But the central moving average is delayed not so strong and allows to set shorter and more accurate stops, therefore being an excellent alternative.

Thus, you can use any variant for initial calculation of the risk and further trailing positions. Note that in this case much will depend on the trading instrument: The last thing to pay attention to is the profit target. The authors recommend the split position into parts, each of which have their values of take-profit set uniform breakdown by the number of points , while after working out the first order the stop-loss must be set on all outstanding transactions to the breakeven.

Trade Forex Like a Sniper…Not a Machine Gunner » Learn To Trade

In our opinion, this approach is only partially correct, since the very idea of the breakdown is entirely correct and tactically successful, but the problems can occur with the levels. The Sniper strategy was created in , which is already alarming for the experienced speculators, and it is not even about the subsequent crisis, which broke out after a year: Thus, today the market is completely different and is in a phase of low volatility, so if in the profit fixed at the level of, for example, points before the trend change was triggered, today the price may fail to go that far.

Consequently, the transaction is better to break into two parts and then accompany the position as follows:. Strengths and weaknesses inherent in the Sniper strategy. In conclusion, we should note that even the simple at first glance Sniper strategy, for which the parameters of the main indicators cannot be corrected by default if you do not edit the code , carries both hidden opportunities and dangers. In particular, the following advantages specific to the considered strategy can be formulated according to the results of this review:.

In addition, there are some difficulties with the Sniper Stop: Forex About the site. Open an account Forex brokers Forex bonuses Forex education Trading advisors Trading strategies Forex indicators Quotations Economic calendar.

Sniper strategy and working indicators You can find several versions of this method online, with various additions, modifications, and even scripts, but the pattern for the base and concurrently the most reliable version will include a set of the following indicators: Sniper - a combination of moving averages, presented on the chart in the form of three lines and giving audible signals when the notification is on Sniper Stop —a modification of the standard Parabolic SAR, which points have been assigned different colors for the bullish and bearish market.

Intended for setting the stop-loss and trailing positions; Sniper Trend A and Sniper Trend B — special charts in the "basement" windows.

The figure below shows an example to buy the combination of signals will be completely the opposite for the deals to sell: All information is provided for reference and cannot be considered as a recommendation. Website administration is not responsible for damages resulting from the use of the information provided.

Settlement of transactions in the foreign exchange and stock markets involves taking concomitant, high risks by the trader.

Before you start trading, you need to understand how much you can lose, and in no case change this amount. Please only risk with the funds available to you, and do not use borrowed money in trading.