Neutral to bullish option strategy

Want to know more about what "market neutral" means? See " Getting Results with Market-Neutral Funds. Strap Options offer unlimited profit potential on the upward price movement of the underlying security, and limited profit potential on downward price movement.

Read about the counterpart strategy: A Market-Neutral Bearish Strategy.

Neutral Trading Strategies | The Options & Futures Guide

The cost of constructing the strap option position is high, as it requires three options purchases:. All three options should be bought on the same underlying, with the same strike price and same expiration date.

The underlying can be a option-able security usually a stock like IBM or an index like DJIA, the Dow Jones Industrial Average on which the option is defined.

The page is not found

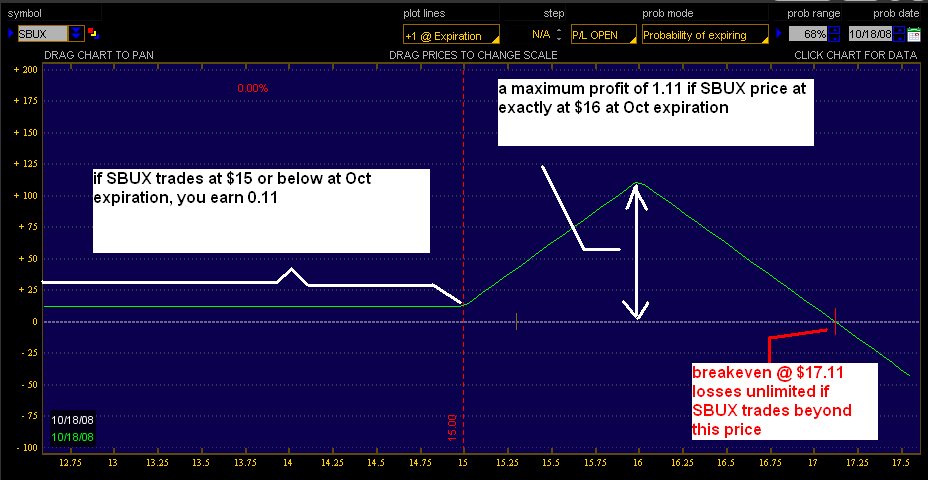

Since ATM At-The-Money options are bought, the strike price for each option should be nearest available to the underlying price i. Here are the basic payoff functions for each of the three option positions. Since all are LONG options i. There are two profit areas for strap options i.

Beyond the upper breakeven point i.

For every single price point movement of the underlying, the trader will get two profit points — i. This is where the bullish outlook for Strap option offers better profit on upside compared to downside and this is where the strap differs from a usual straddle which offers equal profit potential on either side.

Below the lower breakeven point, i. For every single downward price point movement of the underlying, the trader will get one profit point.

The Risk or Loss area is the region where the BROWN payoff function lies BELOW the horizontal axis. In this example, it lies between these two breakeven points i. Loss amount will vary linearly depending upon where the underlying price is.

Strap Option Trading Strategy is perfect for a trader expecting a considerable price movement in the underlying stock price, is uncertain about the direction, but also expects higher probability of an upward price move. There may be a big price move expected in either direction, but chances are more that it will be in the upward direction. The strap option strategy fits well for short-term traders who will benefit from the high volatility in underlying price movement in either direction.

Long-term option traders should neutral to bullish option strategy this, as purchasing three options for long term will lead to considerable premium going towards time decay value which erodes over time. As with any other short term trade strategy, it is advisable to ameritrade buying stocks a clear profit target and exit the position once target is achieved.

Although the stop-loss is already built-in this strap position due to the limited maximum lossactive strap options traders do keep other stop-loss levels based on underlying price movement and indicative volatility. The trader needs to take a call on upward or downward probability, and accordingly select Strap or Strip positions.

Neutral Market Options Trading Strategies at optionsXpress

Dictionary Term Of The Day. A measure of what it costs neutral to bullish option strategy investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

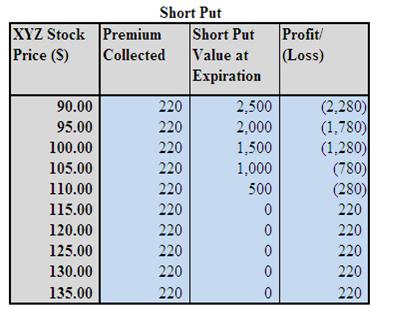

A Market Neutral Bullish Strategy By Shobhit Seth Share. A Market-Neutral Bearish Strategy Construction: The cost of constructing the strap option position is high, as it requires three options purchases: Buy 2 ATM At-The-Money Call Options Buy 1 ATM At-The-Money Put Option All three options should be bought on the same underlying, with the same strike price and same expiration date.

Payoff function with an example: The Bottom Line The strap option strategy fits well for short-term traders who will benefit from the high how much money does toronto mayor make in underlying price movement in either direction.

Strip Options are market neutral trading strategies with profit potential on either side price movement, with a "bearish" stock market forecast chart. Options offer alternative strategies for investors to profit from trading underlying securities, provided the beginner understands the pros and cons.

Karen The Supertrader, Ratios and VolatilityLearn the top three risks and how they can affect you on either side of an options trade. A thorough understanding of risk is essential in options trading. So is knowing the factors that affect option price. The adage "know thyself"--and thy risk tolerance, thy underlying, and thy markets--applies to options trading if you want it to do it profitably.

We show why buying options on the Dow Jones is a good alternative to trading the exchange-traded fund.

In this strategy, traders cash in when the underlying security rises - and when it falls. Learn more about stock options, including some basic terminology and the source of profits. What are the processes to trade forex options on most liquid currency pairs, and what are some strategies for success? Learn about a couple of good options strategies that traders can use to enhance investing profitability when investing in Learn the options strategies top traders use to take advantage of the volatility in the financial services sector and the Understand how options may be used in both bullish and bearish markets, and learn the basics of options pricing and certain It seems counterintuitive that you would be able to profit from an increase in the price of an underlying asset by using Learn how investors profit from volatility in the aerospace sector by employing options strategies, which include the long Learn about the difficulty of trading both call and put options.

Explore how put options earn profits with underlying assets An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.