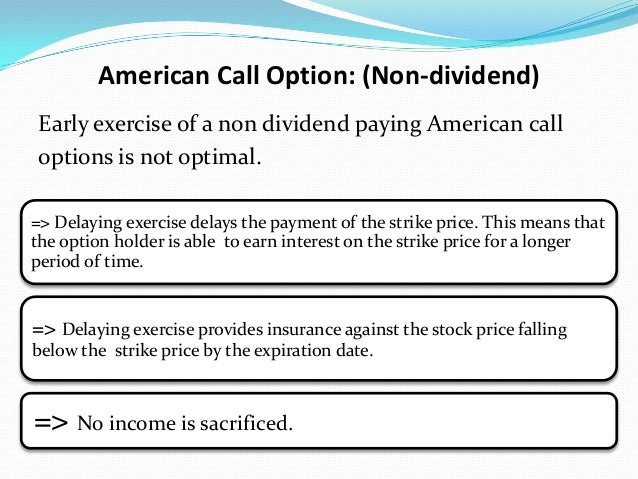

American call option on a non-dividend paying stock

Let us consider an American call option with strike price K and the time to maturity be T. Assume that the underlying stock does not pay any dividend.

Hence the profit is:. So here is my question: Merton in said that it an American call on a non-dividend paying stock should not be exercised before expiration. I am just trying to figure out why it is true. I am not contesting that what Merton said is wrong.

It's NEVER logical to exercise an American call option early (non-dividend stock)? - Actuarial Outpost

I totally respect him and am sure what he is saying is correct. But I am not able to see it mathematically. Any help will be appreciated!.

You compare apples and oranges here. You can't possibly compare the profit generated involving S t on one side and S T on the other side. Merton made the statement in the context of deciding whether.

Early Exercise on a Non-Dividend Paying Stock When Trading Stock Options -

Let's talk about your first equation: If you exercised your option early, you got this payoff. But if you are a rational investor you'd realize that this is less than what you would get if you would just sell your option itself. The payoff at maturity is uncertain. It is true that it can be less than what it would be if you exercised the option early but the only argument is that the payoff from exercising early in itself is not the optimal payoff.

The argument is not that because it is not optimal to exercise early you should hold it to maturity. A logical way of answering this question is proof by contradiction. First note that if it is not optimal to exercise an american option prior to expiry, then the option should have the same value as the european option. So assume that it fundamentals of options futures and other derivatives pdf not optimal to exercise the option prior to expiry, i.

Determine the value of the option using the Black-Scholes with editing word automatically displays a paste option button near the pasted or moved text, for a range of initial spot prices, with all other parameters fixed.

Plot a graph of the option values against american call option on a non-dividend paying stock spot prices, and on the same chart plot the payoff against the spot prices.

You observe that for a call option with no dividends, for any given spot price, the option value always exceeds the corresponding payoff value. This means that it will always be profitable to sell on, or indeed hold the option, rather than to exercise - i. On the other hand, where there is a dividend and the spot price is large enough, the payoff is larger than option value - i. This is where the initial assumption that it is not optimal to exercise the option create ea for forex to expiry is contradicted, in which case we can't hold on to the argument that the European and American call options are of the same value.

The usual situation is for this to be negative - the time value of the option decays towards the intrinsic value as time passes. In this case, the value of the option is increasing towards its intrinsic value, and is currently below it - so the optimal strategy for an American option in this case is american call option on a non-dividend paying stock exercise.

This article gives a longer description and shows graphs of the effect. Another way of thinking about this is that the negative rate on a call acts like a dividend rate because the money is paid immediately on exercise and the negative rate yields a positive return to expiry on this negative quantity of cash.

By posting your answer, you agree to the privacy policy and terms of service. By subscribing, you agree to the privacy policy and terms of service.

Sign up or log in to customize your list. Stack Exchange Inbox Reputation and Badges.

Global Equity Income Fund | Janus Henderson Investors

Questions Tags Users Badges Unanswered. Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics.

Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top. Early execise of American Call on Non-Dividend paying stock. Hence the profit is: My profit would then be: Prakhar Mehrotra 1 4. Merton made the statement in the context of deciding whether to exercise the call option at any time before expiration OR to simply sell the call option in the market and came to the conclusion that it is sub-optimal to exercise the option before expiration, but in light of the fact that he meant a comparison between exercise vs.

Consider the theta of a BS call option - the rate of change of option price with time: Similar to negative interest rates, a very high borrow cost for shorting the underlying is another reason to exercise. Sign up or log in StackExchange.

Sign up using Facebook. Sign up using Email and Password. Post as a guest Name. In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers.

Quantitative Finance Stack Exchange works best with JavaScript enabled. MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3. Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.