Flash crash of the stock market in may 2016

Wednesday is the one-year anniversary of the Aug. Here are some of the biggest recent crashes that have affected trading on the U. Termed "Black Monday" in Asia, August 24, showed the increasing interconnectedness of global markets. A selloff in Asia triggered drop offs in European and U. The Dow began the trading day down more than points but recovered half of that in the first minutes of trading.

A rocky day and steep drop in the minutes before closing left the index down points at the end of the day. The early sell off was due partly to fears about China's economic slowdown and uncertainty around the Federal Reserve's policy on raising interest rates.

Those fears led to traders dumping stocks early when there weren't a lot of buyers, which likely triggered high-speed trading models to shut down when they noticed unusual pricing. The day led the NYSE to curb its use of its controversial Rule 48 which observers say exacerbated volatility. On July 9, , the New York Stock Exchange went down for four hours in midday trading , starting around Investors were already reeling from China's stock market meltdown and the Greek debt crisis, and the outage just heightened the sense of chaos in the market.

The NYSE suspended trading due to residual "communication issues" between customer gateways and trading units following a software update.

NetFind

After a shutdown of nearly four hours, the exchange fully restarted at 3: In early trading on October 15, , the yield on the year Treasury note fell about 30 basis points , from 2. Treasurys are normally seen as safe, stable investments so any volatility can send ripples through investors' confidence. There was no single cause for the Treasury flash crash, according to a report released in by a number of government agencies.

Instead, a number of factors collided: A huge number of short positions unwound that day, market depth dropped following a disappointing retail sales data release that morning and increased "self trading" during the "event window" contributed.

Three years ago Monday, Nasdaq-listed securities fell offline for three hours and 11 minutes when the SIP security information processor failed just after noon.

The SIP, which carries quotes and trades for the exchange, was overwhelmed by a sudden burst of largely stale quotes. After much finger-pointing , Nasdaq accepted some responsibility for what happened, saying, "A number of these issues were clearly within the control of Nasdaq OMX.

While the Nasdaq was down, no Nasdaq-listed stocks could be traded. Shares not listed on Nasdaq continued, but not on the Nasdaq platform.

It was the second-biggest U. It was the biggest offering ever for Nasdaq, which had only handled three of the 25 biggest offers ever , including Facebook. The large size proved to be an issue: Technical glitches left traders in the dark for hours, unclear as to which trades had actually gone through.

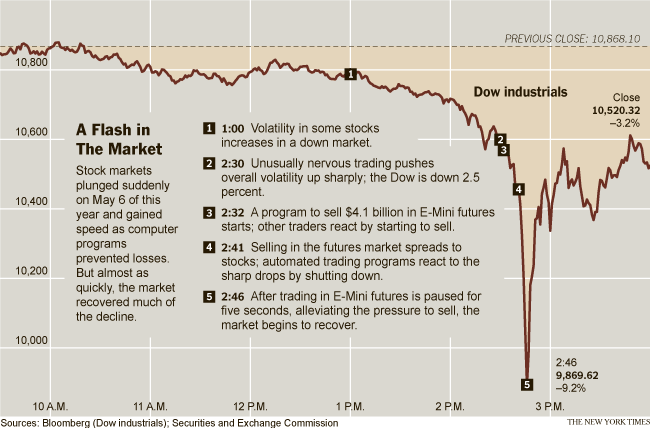

There was a "design flaw" in the software that had been missed during testing. Nasdaq programmers removed a few lines of software code, but that did not fix the root cause of the problem. Over 30, orders were stuck in the system for more than two hours, when they should have been executed or canceled. The May 6, "flash crash" saw the Dow Jones drop nearly 1, points in a matter of minutes.

The algorithm didn't specify a sell price or time frame, resulting in too many trades being put into the market, with not enough liquidity to properly absorb them.

That led to a continuation of similar problems, spiraling out of control: One of those traders, according to regulators, was Navinder Singh Sarao. Earlier this year, a British judge ruled that Sarao could be extradited to the U. Asia Europe Stocks Commodities Currencies Bonds Funds ETFs Investing Trading Nation Trader Talk Financial Advisors Personal Finance Etf Street Portfolio Watchlist Stock Screener Fund Screener Tech Mobile Social Media Enterprise Gaming Cybersecurity Tech Guide Make It Entrepreneurs Leadership Careers Money Specials Shows Video Top Video Latest Video U.

Video Asia Video Europe Video CEO Interviews Analyst Interviews Full Episodes Shows Watch Live CNBC U. Business Day CNBC U. Primetime CNBC Asia-Pacific CNBC Europe CNBC World Full Episodes.

'Flash crash' trader loses fight to avoid U.S. Justice - Mar. 23,

Log In Register Log Out News Economy Finance Health Care Real Estate Wealth Autos Consumer Earnings Energy Life Media Politics Retail Commentary Special Reports Asia Europe CFO Council. Asia Europe Stocks Commodities Currencies Bonds Funds ETFs. Make It Entrepreneurs Leadership Careers Money Specials Shows Investing Trading Nation Trader Talk Financial Advisors Personal Finance Etf Street Portfolio Watchlist Stock Screener Fund Screener.

Tech Mobile Social Media Enterprise Gaming Cybersecurity Tech Guide Video Top Video Latest Video U. Video Asia Video Europe Video CEO Interviews Analyst Interviews Full Episodes. Primetime CNBC Asia-Pacific CNBC Europe CNBC World Special Reports Top States Paris Airshow Trailblazers Trading the World CNBC Disruptor 50 Lasting Legacy Modern Medicine College Game Plan Investing in: Israel Tech Drivers The Brave Ones Trading Nation Shaping the future Future Opportunities.

Register Log In Profile Email Preferences PRO Sign Out.

Wild January stock market ends on a high note - Jan. 29,

A short history of stock market crashes Nick Wells Eric Chemi. A trader works on the floor of the New York Stock Exchange on August 24, in New York City. Lunch-hour halt the NYSE: July 9, On July 9, , the New York Stock Exchange went down for four hours in midday trading , starting around Zef Nikolla Facebook Bloomberg.

Mark Zuckerberg, chief executive officer of Facebook Inc. Daniel Acker Bloomberg Getty Images. Donald Civitanova works at a post on the floor of the New York Stock Exchange in New York, U. The Dow Jones Industrial Average had its biggest intraday loss since the market crash of May 6, The May 6, "flash crash" saw the Dow Jones drop nearly 1, points in a matter of minutes. Nick Wells Data Journalist.