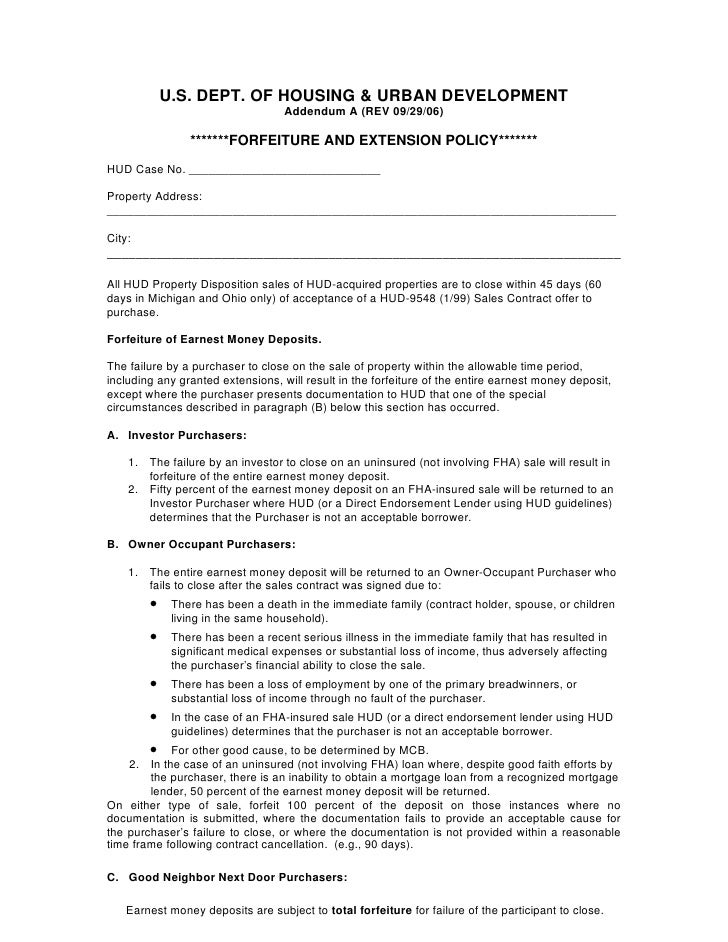

Forfeiture earnest money addendum

Buyer incldued a preapproval letter. My agent has been calling their lender on a daily basis and seems to be getting the run around. Your email alert settings have been saved. Access all your email alerts in your My Trulia account anytime! Menu Icon Click to open Mobile Menu. Buy Rent Mortgage Sell Find an Agent For Professionals Local Scoop More Trulia Blogs All Trulia Neighborhood Guides Go Mobile with Trulia Advice Ask a Question Help Center For Professionals.

Can I keep a buyers earnest money if they default on the close on or before date? Highest rated Recent Oldest. Wed Dec 11, Thanks for the feedback. The next day they FINALLY received the clear our strategy worked!! The whole process was a nightmare THANK GOD it's finally over!!! We are loving our new home!!! Shawn Carver , Agent, Grandville, MI. Most of the time the buyer must get approved and that is stated in the contract. You need to put your home back on the market.

Wed Oct 30, Here is what the PA says under Cash Sale with new mortgage: Ok so I get it, the entire sale is contingent upon them being able to secure a mortgage. Ok so throw out the "in the event the buyer fails to fulfil obligation" clause since the deal is contingent upon them being able to secure a mortgage Most of them have the financial clause in them. Even with good pre-approvals, sometimes the financing doesn't go through for 1 reason or another.

They might of been border line.

Not Found

Your agent should of explained why the extensions were needed. What the problem was with the financing. You will also need to get a mutual release of the Purchase agreement before you can put it back on the market. This is why you need to have your agent check with their broker to verify everything. If you do get it back, your listing agreement will state whether you receive the whole amount or if your listing agency will receive part of it.

Becky Drob , Agent, Shelby, MI. That is what you hire an agent for. Becky Drob Weichert Realtors-Excel. Tue Oct 29, Thank you for the response sigrid. So based on what you said, a seller can't execute legal recourse against a buyer who holds them up for 3 months because of their own financial discrepancies?

That doesn't seem to make sense Fact of the matter remains, they've breached the contract not once, but twice. If they couldn't get financing, shouldn't I have known before the scheduled closings?

Where would the financial clause be located on a standard pa? I can't seem to find it? The Broker would also receive a part of the deposit, most would be entitled to half. I know you want to be upset with the buyer but when things like this happens it is the responsibility of your agents. A great agent means everything, they are worth their weight in gold.

Choose your agent as you would your doctor, very carefully. Keep it moving and get that property sold!!!!!!!!!! Respectfully, Thea Baker mstheabaker gmail. The extension came about because of the financing. Since financing wasn't able to go through, I believe they will get their EMD back.

Hope this helps you. Sigrid Garrick Keller Williams Realty Thanks for the responses. The PA we signed was your standard michigan based zip? Basically the standard purchase agreement contract.

By no fault have I done anything to hold up this closing. My realtor says that I can absolutely file a letter of default to the buyer informing them they are to close within 7 days or forfeit thier earnest deposit Since they didn't close by not only 1, but 2 scheduled closing dates.

The PA states under "default" section that I am legally entitled to receive compensatory damages and the earnest money section 4. My realtor also said the buyer can object to the default in which it would go to litigation. However I don't see how I could possibly lose since we did absolutely nothing to hold up Closing?? Thanks again for the advice. Kathy Persha , Agent, Birmingham, MI.

As the other agents have said, it depends entirely on how your contract is written. However, most contracts do have a financing clause and if the buyer cannot get the clear to close from their lender, then they will most likely get a denial letter for their mortgage. In most contracts, the wording says that if the buyer cannot get mortgage approval, then they are entitled to their earnest money deposit back.

Until you get this settled, you really cannot relist the property unless, of course, the contract date to close has passed and there is no extension. In that case, your agent could get you out of the contract and allow you to relist. But again, it is all about how the contract is worded. Kathy Persha, Assocciate Broker GRI, SFR Keller WIlliams Realty.

So not seeing the sales contract and its terms, we cannot really give any advice here, and your Realtor should be able to. If not then it may be time to contact an experienced Real Estate attorney in your area for advice Alan May , Agent, Evanston, IL.

That depends entirely on the language written within your accepted contract. It may be time to consult with a real estate attorney.

Zip form Purchase Agreement do have a mortgage contingency clause. Your real estate agent should have been looking for a full loan approval state time stated on the contract. A default is defined as when the buye or seller can perform and does not if they cannot get a mortgage they cannot perform. It does not 3 months to get a mortgage approval and your property should have been put back on the market. You don't need the deposit, you need a Mutual Release and you cannot get that if you are trying to get the deposit because the buyer would have sign off.

Don't waste anymore of your time on this buyer. Can I as a seller keep the buyers earnest deposit check if all contingency was removed and pass closed date on a short sale? Can I get a refund of all fees paid due diligence, appraisal, earnest money, and inspection if the seller does not close on our agreed upon date?

Does the seller have the right to keep my earnest money if they supplied false information on the disclosure? How can buyers protect themselves from a lender causing them to miss their closing date? Must buyers risk earnest money on the diligence lenders? Ask our community a question.

The Importance of Being Earnest: All About Earnest Money Deposits

Real Estate in Sterling Heights. Home Selling in Nearby Locations. Royal Oak Fraser Hazel Park Pleasant Ridge Berkley Troy Madison Heights Clawson Warren Center Line. Popular Categories in Moving Curb Appeal Financing Rental Basics Rentals For Rent Rent vs Buy Market Conditions Using Trulia Tech Tips How To District Of Columbia Real Estate. New Hampshire Real Estate.

New Jersey Real Estate. New Mexico Real Estate. New York Real Estate. North Carolina Real Estate.

North Dakota Real Estate. Rhode Island Real Estate. South Carolina Real Estate.

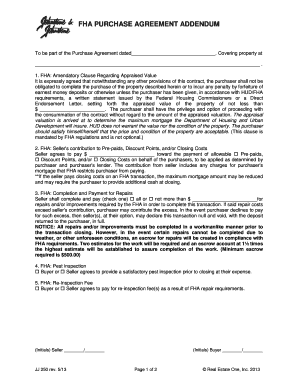

Loan Finance Software Suites | Comprehensive List of Financial Tools and Forms

South Dakota Real Estate. West Virginia Real Estate. District Of Columbia Rentals. Real Estate Agent Portal. Visit our Help Center to find the answer.