How buying and selling stocks works

If the thought of investing in the stock market scares you, you aren't alone. False promises and highly public stories of investors striking it rich or losing everything skew perceptions of the reality of the average investor. By understanding a little more about the stock market — and how the stock market works — you'll likely find it isn't as scary as you may think and that it's a viable investment.

When you buy a stock, you're buying a piece of the company. When a company needs to raise money, it issues shares. This is done through an initial public offering IPO , in which the price of shares is set based how much the company is estimated to be worth, and how many shares are being issued. The company gets to keep the money raised to grow its business, while the shares also called stocks continue to trade on an exchange, such as the New York Stock Exchange NYSE.

Traders and investors continue to buy and sell the stock of the company on the exchange, although the company itself no longer receives any money from this type of trading.

The company only receives money from the IPO. Want to start buying stocks? Find out which broker offers the most easy-to-use interface here. Traders and investors continue to trade a company's stock after the IPO because the perceived value of company changes over time. Investors can make or lose money depending on whether their perceptions are in agreement with "the market. Trying to predict which stock will rise or fall, and when, is very difficult.

Over time stocks as a whole tend to rise , which is why many investors choose to buy a basket of stocks in various sectors this is called diversification and hold them for the long-term. Investors who use this approach do not concern themselves with moment-to-moment fluctuations in stock prices.

The ultimate goal of buying shares is to make money by buying stocks in companies you expect to do well, those whose perceived value in the form of the share price will rise.

Mature and established companies may also pay a dividend to shareholders. A dividend is a cut of the company's profit, which the company sends to shareholders as long as the company continues to pay the dividend.

Aside from the dividend, the share price will continue to fluctuate. The losses and gains associated with the share price are independent of the dividend. Dividends can be large or small — or nonexistent many stocks don't pay them.

Investors seeking regular income from their stock market investments tend to favor buying stocks that pay high dividends. When you buy shares of a company, you own a piece of that business and therefore have a vote in how it is run.

While there are different classes of shares a company can issue shares more than once , typically owning shares gives you voting rights equal to the number of shares you own. Shareholders as a whole, based on their individual votes, select a board of directors and can vote on major decisions the company is making. For every stock transaction , there must be a buyer and a seller. When you buy shares of stock called a " lot " someone else must sell it to you.

Either buyers or sellers can be more aggressive than the other, pushing the price up or down. When the price of a stock goes down, sellers are more aggressive because they are willing to sell at a lower and lower price. The buyers are also timid and only willing to buy at lower at lower prices. The price will continue to fall until the price reaches a point where buyers step in and become more aggressive and willing to buy at higher prices, pushing the price back up.

Investors don't all have the same agenda, which leads traders to sell stocks at different times.

One investor may hold stock that has grown significantly in price and sells to lock in that profit and extract the cash. Another trader may have bought at a higher price than the stock now sells for, putting the trader in a losing position.

That trader may sell to keep the loss from getting bigger. Investors and traders may also sell because they believe a stock is going to go down, based on their research, and want to take their money out before it does.

How many shares change hands in a day is called volume.

How Stock Trading Works - Basic Steps

Many stocks on major exchanges, such as the NYSE or NASDAQ , have millions of shares issued. That means potentially thousands of investors in a stock may decide to buy or sell on any particular day.

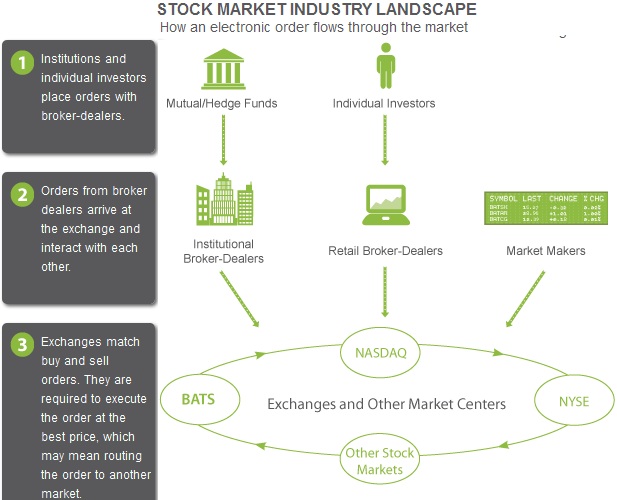

A stock that has lots of daily volume is attractive to investors because the volume means they can easily buy or sell their shares whenever they please. When volume is inadequate, or no one is actively trading a stock, it's still usually possible to dispose of a small number of shares because the exchanges mandate certain traders firms to provide volume.

These traders are commonly referred to as market makers and act as buyers and sellers of last resort when there are no buyers or sellers. They don't have to stop a stock from rising or falling though, which is why most traders and investors still choose to trade stocks with lots of volume, and thus not rely on these "market makers," which are now mostly electronic and automated.

There are still people on the floor of the NYSE. Those men and women in the blue jackets trade stocks for their firms and also help facilitate orders from the public. Stocks are issued by companies to raise cash, and the stock then continues to trade on an exchange. Overall stocks have risen over the long-term, which makes owning shares attractive. There are also additional perks such as dividends income , profit potential and voting rights.

Stocks Basics: How Stocks Trade

Share prices also fall, though, which is why investors typically choose to invest in a wide array of stocks, only risking a small percentage of their capital on each one. Shares can be bought or sold at any time, assuming there is enough volume available to complete the transaction, which means investors can cut losses or take profits whenever they wish.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

How Do I Actually Make Money From Buying Stock?

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. How the Stock Market Works By Cory Mitchell Updated April 14, — 3: What Is a Stock or Share?

Buying and selling stock: how the stock market works - BBVA NEWS

Volume How many shares change hands in a day is called volume. The Bottom Line Stocks are issued by companies to raise cash, and the stock then continues to trade on an exchange. Without a doubt, common stocks are one of the greatest tools ever invented for building wealth. Common sense or common folly?

Discover some approaches to circumventing typical stumbling blocks on the road to profitable investing. Read on to learn more about the nature of stocks and the true meaning of ownership. Find out how dividends affect the price of the underlying stock, the role of market psychology and how to predict price changes after dividend declaration. A broker won't lose money when a stock goes down because he or she is usually nothing more than an agent acting on sellers' An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.