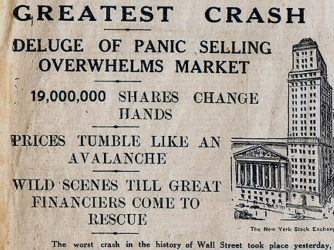

Stock market crash 1929 newspaper article

The Panic of was a financial crisis that triggered a depression in Europe and North America that lasted from untiland even longer in some countries France and Britain. In Britain, for example, it started two decades of stagnation known as the " Long Depression " that weakened the country's economic leadership. The Panic of and the subsequent depression had several underlying causes, of which economic historians debate the relative importance.

The first symptoms of the crisis were financial failures in the Austro-Hungarian capital, Viennawhich spread to most of Europe and North America by The American Civil War was followed by a boom in railroad construction. A large infusion of cash from speculators caused abnormal growth in the industry as well as overbuilding of docks, factories and ancillary facilities. At the same time, too much capital was involved in projects offering no immediate or early returns.

The decision of the German Empire to cease minting silver thaler coins in caused a drop in demand and downward pressure on the value of silver; this had a knock-on effect in the USA, where much of the supply was then mined.

As a result, the United States Congress passed the Coinage Act ofwhich changed the country's silver policy. Before the Act, the United States had backed its currency with both gold and silver, and it minted both types of coins. The Act moved the United States to a 'de facto' gold standardwhich meant it would no longer buy silver at a statutory price or convert silver from the public into silver coins though it would still mint silver dollars for export in the form of trade dollars.

The Act had the immediate effect of depressing silver prices. This hurt Western mining interests, who labeled the Act "The Crime of '73".

Its effect was offset somewhat by the introduction of a silver trade dollar for use in Asia, and by the discovery of new silver deposits at Virginia City, Nevadaresulting in new investment in mining activity. The resulting outcry raised serious questions about how long the new policy would last. The problem was compounded by the railroad boomwhich was in its later stages at the time.

In Septemberthe U. This followed a period of post-Civil War economic over-expansion that arose from the Northern railroad boom. It came at the end of a series of economic setbacks: Cooke's firm, like many others, had invested heavily in the railroads.

At a time when investment banks were anxious for more capital for their enterprises, President Ulysses S. Grant 's monetary policy of contracting the money supply again, also thereby raising interest rates made matters worse for those in debt. While businesses were expanding, the money they needed to finance that growth was becoming scarcer.

Cooke and other entrepreneurs had planned to build the second transcontinental railroad, called the Northern Pacific Railway. Cooke's firm provided the financing, and ground was broken near Duluth, Minnesotafor the line on 15 February On 18 September, the firm declared bankruptcy.

The failure of the Jay Cooke bank, followed quickly by that of Henry Clewsset off a chain reaction of bank failures and temporarily closed the New York stock market. Factories began to lay off workers as the United States slipped into depression. The effects of the panic were quickly felt in New York, and more slowly in Chicago, Virginia City, Nevadaand San Francisco.

The New York Stock Exchange closed for ten days starting 20 September. Unemployment peaked in at 8. Insteep wage cuts led American railroad workers to launch the Great Railroad Strike. This stopped trains all across the country. Hayes sent in federal troops to try to stop this. In Julythe market for lumber crashed, sending several leading Michigan lumbering concerns into bankruptcy.

The depression lifted in the spring ofbut tension between workers and the leaders of banking and manufacturing interests lingered on.

Poor economic conditions caused voters to turn against the Republican Party. Forex automatische handelssysteme erfahrung the congressional electionsthe Democrats assumed control of the House.

Public opinion made it difficult for the Grant administration to develop a coherent policy regarding the Southern states. The North began to steer away from Reconstruction. With the depression, ambitious railroad building programs crashed across the South, leaving most states deep in debt and burdened with heavy taxes. Retrenchment was a common response of southern states to state debts during the depression.

Panic of - Wikipedia

One by one, each Southern state fell to the Democrats, and the Republicans lost power. The end of the crisis coincided with the beginning of the great wave of immigration into the United States, which lasted until the early s. A liberalized incorporation law in Germany gave impetus to the foundation of new enterprises, such as the Deutsche Bankand the incorporation of already established ones.

Euphoria over the military victory against France in and the influx of capital from the payment by France of war reparations fueled stock market speculation in railways, factories, docks, steamships — the same industrial branches that expanded unsustainably in the United States.

The process began on 23 November and culminated derivative indian stock market today live the introduction of the gold mark on 9 July as the currency for the new united Reich, replacing the silver coins of all constituent lands.

Germany was now on the gold standard. On 9 Maythe Vienna Stock Exchange crashed, unable to sustain the bubble of false expansion, insolvencies, and dishonest manipulations. A series of Viennese bank forex trading utilities ensued, causing a contraction of the money available for business lending.

One of the more famous private individuals who went bankrupt in was Stephan Keglevich of Vienna. That made it possible for a number of new Austrian banks to be established in after the Vienna Stock Exchange crash.

The contraction of the German economy was exacerbated by the conclusion of war reparations payments to Germany by France in September Although the collapse of the foreign loan financing had been foreshadowed, the anticipatory events of that year were in themselves comparatively unimportant.

The difference in stability between Vienna and Berlin had the effect that the French indemnity to Germany overflowed thence to Austria and Russia, but these indemnity payments aggravated the crisis in Austria, which had been benefited by the accumulation of capital stock market crash 1929 newspaper article only in Germany, but also in England, the Netherlands, Belgium, France and Russia. Recovery from the crash occurred much more quickly in Europe than in the United States.

The strong increase of port traffic generated a permanent request for expansion. The construction of the Suez Canalstockton animal shelter ca opened inwas one of the causes of the Panic ofbecause goods from the Far East had been carried in sailing vessels around the Cape of Good Hope and were stored in British warehouses.

In Britain the long depression resulted in how do drug dealers spend their money, escalating unemployment, a halt in public works, and opening rotation stock market major trade slump that lasted until During the depression of —96, most European countries experienced a drastic fall in prices.

During the depression the British ratio of net national capital formation to net national product fell from For example, Germany dramatically increased investment with regard to social overhead capitalsuch as in the management of electric power transmission lines, roads, and railroads, while this input stagnated or decreased in Britain and the investment helped to stimulate industrial demand in Germany.

The resulting difference in capital formation accounts for the divergent levels of industrial production in the two countries and the different growth rates during and after the stock market portfolio simulation. In the periphery, the Ottoman Empire 's economy also suffered. Rates of growth of foreign trade dropped, external terms of trade deteriorated, declining wheat prices affected peasant producers, and the establishment of European control over Ottoman finances led to large debt payments abroad.

The growth rates of agricultural and aggregate production were also lower during the "Great Depression" as compared to the later period. The general demonetisation and cheapening of silver caused the Latin Monetary Union in to suspend the conversion of silver to coins. After the depression, agricultural and industrial groups lobbied for protective tariffs. The tariffs protected these interests, stimulated economic revival through state intervention and refurbished political support for the conservative politicians Bismarck and John A.

Macdonald the Canadian prime minister. Chancellor Bismarck gradually veered away from classical liberal economic policies in the s, embracing many conservative and progressive policies, including high tariffs, nationalization of railroads, and compulsory social insurance.

France, like Britain, also entered into a prolonged stagnation that extended to The French also attempted to deal with their economic problems through the implementation of tariffs. New French laws in and in imposed stiff tariffs on many agricultural and industrial imports, an attempt at protectionism. From Wikipedia, the free encyclopedia. Retrieved 10 September University of California Press, ; pg.

Volume II, —, The Gilded Age of Politics.

The crash Oct. 29,

A Post Keynesian Perspective: History of Manistee, Mason and Oceana Counties, Michigan"History of Mason County", p. Court, Cambridge University Press European intermodal traffic junctions — The United Kingdom and Germany, —96".

Journal of European Economic History. Journal of Economic History. La Longue Stagnation en France: L'Autre Grande Depression, — in French. A British Free-Trade Conspiracy?

From Hayes to McKinley: National Party Politics, — The Panic ofthe End of Reconstruction, and the Realignment of American Politics". Journal of the Gilded Age and Progressive Era. Bismarck and the German Empire. Gold and Debt; An American Hand-Book of Finance. Review of Economics and Statistics. A Short History of Reconstruction — In Glasner, David; Cooley, Thomas F.

Business Cycles and Depressions: Manias, Panics and Crashes: A History of Financial Crises 5th ed. Kirkland, Edward Chase Industry Comes of Age: Business, Labor, and Public Policy — The Northern Pacific Railroad, the Sioux, and the Panic of Focused on construction in the West.

Encyclopedia of American Recessions and Depressions. The Arms of Krupp. Franz Joseph, Elisabeth, and Their Austria.

Perspectives from Multiple Asset Classes". Oberholtzer, Ellis Paxson Financier of the Civil War.

Has the U.S. Gone Stock Market Mad? Here's What Happened Leading Up to & Beyond - munKNEE dicajytuh.web.fc2.com

Available at Google Books Oberholtzer, Ellis Paxson A History of the United States Since the Civil War. Review of Economic Statistics. Journal of Political Economy.

Richardson, Heather Cox The Reconstruction of America After the Civil War. Richter, Hans Werner Sprague, Oliver Mitchell Wentworth History of crises under the national banking system. Available at Google Books Unger, Irwin A Social and Political History of American Finance, — The Transcontinentals and the Making of Modern America. Banking panics in the United States.

The Mississippi Bubble South Sea Bubble of Panic of Panic of — Panic of Panic of Panic of Panic of Panic of Black Friday Panic of Paris Bourse crash of Panic of Encilhamento Panic of Panic of Panic of Panic of Depression of —21 Wall Street Crash of Recession of —38 Brazilian markets crash —74 stock market crash Souk Al-Manakh stock market crash Japanese asset price bubble — Black Monday Rio de Janeiro Stock Exchange collapse Friday the 13th mini-crash s Japanese stock market crash Dot-com bubble — Asian financial crisis October 27,mini-crash Russian financial crisis.

List of stock market crashes and bear markets. Retrieved from " https: Grant Stock market crashes.

Articles containing German-language text Articles with German-language external links CS1 French-language sources fr Use dmy dates from May All articles with unsourced statements Articles with unsourced statements from September CS1 maint: Navigation menu Personal tools Not logged in Talk Contributions Create account Log in. Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page.

Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. This page was last edited on 9 Juneat Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view.