Raise interest rates stock market

We no longer check to see whether Telegraph. To see our content at its best we recommend upgrading if you wish to continue using IE or using another browser such as Firefox, Safari or Google Chrome. By Szu Ping ChanPeter Spence, and Jon Yeomans. Latest A watershed moment The Federal Reserve has decided to raise its rates in a watershed moment for the global economy.

It elected to raise its target for the Federal Funds Rate FFR by 0. US and Asian stock markets closed higher overnight while the Fed's move was also greeted positively in Europe, with the major indices advancing by up to 3pc. The price of a barrel of Brent crude fell by close to 3. The pound is down 0. The pound versus the dollar this year. Expect Fed rate rises to be short lived, experts at Standard Chartered have warned. And that is it; we do not expect more rate rises in Closer to home, Capital Economics doesn't think the Bank of England will be tempted to raise rates in the UK just yet.

After Fed hike, markets still don't expect MPC to raise rates for another year. We still expect hike in Q2 A brave stab at tying yesterday's rate rise with the other big bigger?

In fact RBS has come up with a serious discussion on why the US Fed raised interest rates, and what the impact will be.

But it's not clear one was needed," RBS analysts write. Though what they would have called their presentation if the Fed hadn't pushed the button is anyone's guess. The Phantom Rate Risepresumably. Our markets reporter Tara Cunningham writes: European shares have surged in early trade as a long period of uncertainty came to a welcome end. The pan-European FTSEurofirst index rose by as much as 1.

Back in London, the FTSE continued to rally up 1. The South African rand eased after the rate hike triggering a rise in equities. South African-exposed Old Mutual and Investec were the top gains on the FTSE and respectively, rising between 7 and 8pc. Investors re-risk after the Fed decision. Germany 's benchmark index Dax trades 1.

The hike was communicated very effectively and the Fed acted in line with the expectations it had created, while ensuring that it got the message across that futures hikes will be gradual, thereby reassuring investors everywhere that there is no reason to panic. With European markets about to open, we'll soon find out if the traders over here have been won over by the Fed's move. Asian investors are liking the Fed's move. The Shanghai Composite Index - China's benchmark index - climbed 1.

The Topix index in Tokyo added 1. A pedestrian is reflected in a stock market indicator board in Tokyo, Japan, December The US Federal Reserve has decided to raise its rates in a watershed moment for the global economy. The move signals the beginning of the end of cheap money and suggests the US economy is back on track.

It also means the US dollar is likely to strengthen. Stock markets across Asia showed gains when they opened on Thursday morning. Japan's Nikkei added 1. Australian stocks climbed 1. The Federal Reserve's basis-point increase was almost a decade in the making and easily one of the most telegraphed in history. So there was some relief that, after months of waiting and several false starts, the move was finally done and dusted.

Alan Ruskinglobal head of forex at Deutsche, said:. The Fed will be absolutely delighted with the lack of volatility across all asset classes. Nothing here to change a view that we can have a moderate 'risk-positive rallyette', even if the probability of a March hike is significantly higher than priced.

Writing in the Washington Posthe has conceded that not going ahead with a rate rise after signalling one so strongly would have been "credibility destroying".

However, he believes that policymakers should never have backed themselves into this corner to begin with. Growth in the second half of may well come in at less than 2pc. There is certainly a real risk that slow speed becomes stall speed becomes recession. On average, mature recoveries like the present one last less than an additional 3 years. And given how low rates are and the political aversion to the use of fiscal policy, a substantial slowdown could have very severe consequences. There is also the risk that inflation expectations start to anchor below 2pc.

This will happen if economic actors conclude as they reasonably can from what they are hearing that the Fed will cap inflation at 2pc but allow it to fall below 2pc in periods of economic slack.

World reacts as Fed raises rates tomorrowspaperstoday bbcpapers pic. Thursday's FT front page: Historic gamble for Yellen as Fed makes quarter-point rise tomorrowspaperstoday pic. Thursday's International NY Times: Thursday's Guardian front page: Banned weapons for sale on Amazon tomorrowspaperstoday bbcpapers pic. Replacing Ben Bernanke at the top of the world's most influential central bank, it would be up to Yellen to guide the Fed in its tentative first steps away from close to zero rates.

She seems - for now - to have managed that process, passing a big test with flying colours. The Federal Open Market Committee - which decides on US interest rates - was unanimous in supporting a rate rise. Yellen managed to silence any dischord on the committee, and bring would be dissenters into line.

Yellen's Fed had managed to ensure that the policy change was well signalled, and investors were prepared. Accordingly, there were no market tantrums in the aftermath of the decision. Stock markets rallied, rather than falling, as might be expected after an announcement that interest rates would be rising.

Salman Ahmed, of Lombard Odier Investment Managers, said: There's been a mixed reaction from Britain's business lobby over the Fed hike, reflecting the disagreement among them over when the Bank of England should follow in tightening policy. The Bank's main interest rate has been unchanged from its record lows of 0. And analysts aren't expecting that to change any time soon. Market pricing implies that the Bank could wait until early before attempting its first rate rise.

Alongside the US, the UK has been one of the best performing advanced economies in recent years, but the Bank of England probably still has a way to go before rising inflationary pressures at home persuade it to follow and up interest rates.

For Britain, higher US interest rates give the Bank of England the flexibility to start normalising rates on this side of the Atlantic as well. Interest rates still need to be normalised, not to tame rising prices but to take away monetary stimulus which has done its job to spur growth, is no longer needed and could be leading to capital misallocation.

US domestic conditions have largely driven this expected increase in US official rates. The US recovery is more advanced and on a sounder footing than that of other major economies. We predict the Bank will hold its nerve until the third quarter ofbut interest rates will need to rise at some point.

Economists Overwhelmingly Expect Fed to Raise Interest Rates in December - WSJ

The longer we wait the greater potential for impact when it comes. While US policymakers have been keen to stress that further increases in rates will be measured, many economists aren't convinced that it will be able to avoid more rapid rises. He, and others, anticipate that the pace of rate rises will pick up in the second half of the next yearas inflation starts to accelerate.

Emerging markets could be particularly vulnerable, as many have amassed greater debts while interest rates have been at historic lows. As these begin to rise, payments on those loans could become unmanageable. BrazilChile and South Africa are among the most exposed, with their currencies likely to slump if the Fed tightens more rapidly than anticipated, according to analysis by Oxford Economics.

There are signs this is already happening, although she "hesitates" to call it a "firm trend". The new dot plots suggest four rate rises next yearthough Yellen cautions that she "strongly doubts" that increases will be "mechanical" or "evenly spaced".

She adds that policymakers nudged down their expectations for inflation next year to 1. Federal Reserve chairman Janet Yellen speaks during a news conference in Washington. Yellen says spreads in high yield debt have been widening in recent months, partly due to falling oil prices. She describes Third Avenue Fund read more about this here as "unusual" because it had "very concentrated positions" in "risky and illiquid bonds". The Securities and Exchange Commission is in touch with Third Avenue, she says.

Lenders are more resilient now compared with before the financial crisis, banks have stronger buffers, and are "well placed to support corporate lending". Here are the chairman's remarks in full.

Markets welcome US Fed's move to raise interest rates - Telegraph

Yellen is surprised that oil prices have fallen so much in recent weeks, but points out that prices merely need to stabilise for the big drops last year to "wash out" of the headline rate. Yellen says policymakers have raised rates now stockton animal shelter ca keep the economy moving along the growth path its on She says that while policymakers are "reasonably close" to achieving one part of their mandate: Policymakers will monitor the data closely in the coming months, though there is no formula on how policymakers would proceed with future rate hikes.

Were you worried about being seen as having a lack of credibility if you didn't move? Yellen said the FOMC decided to move because they felt the conditions we set out for a move, i. She says policymakers have been concerned about risks to the global economy, which "persists". However, she also noted that domestic spending continues to hold up at "a solid pace". She warns against "overblow[ing] the significance" of the first move. Moving now, and slowly will allow policymakers to carefully watch what's going on in the economy.

Traders work on the floor of the New York Stock Exchange NYSE as a television screen displays coverage of U. Federal Reserve Chairmman Janet Yellen shortly after the announcement that the U. Federal Reserve had hiked interest rates for the first time in nearly a decade. Inflation stood at 0.

Yellen repeats that much of the recent downward pressure on inflation has trading alert for binary options strategies and tactics pdf from "transitory factors" such as falling oil prices "that we expect to abate over time".

She says "diminishing labour slack" is expected to put "upward pressure" on inflation in the coming months. Yellen also reminds everyone that it takes time for monetary policy to filter through to the economy. If policymakers delayed rate hikes for "too long" they may have to tighten "relatively abruptly to keep the economy from overheating and inflation from overshooting".

This could push the economy back into recession, she says. She says "even after today's increase the stance remains accomodative", with the FOMC expecting "gradual increases in the Federal Funds Rate.

Yellen wearing purple to hint at how dovish she is, make my trip discount coupons hdfc Prince pic. Wage growth needs to show pickup; participation still below trend. Fed's Yellen says that good progress has kaip pradeti forex prekyba made on jobs, economy is doing well, hike recognises this.

Fed's Yellen says exports subdued by weaker global environment and strong dollar; spending expansion has offset this. Yellen begins her opening statement. She says today's rate hike "marks the end of an extraordinary seven year period" where the world experienced the "worst financial crisis and recession earn 1.25 cash back on net retail purchases the Great Depression".

The Fed's actions have helped with the process of "restoring jobs, raising incomes and easing the economic hardship of millions of Americans". The recovery has come "a long way", she says, but is "still not complete". Inflation is still low, and there is still room for the labour market to improve.

Chart PROVES Stock Market CRASHES EVERY TIME the Fed Increases Interest Rates!Members felt that a modest increase was now "appropriate". Policymakers have raised the reverse repo rate to 0. Analysts had expected the Fed to double the cap, not remove it. The new economic projections are in. Fed policymakers now expect growth of 2. Growth in is expected to be 2. The unemployment rate is expected to raise interest rates stock market at its current level of 5pc this year, and fall to 4.

Policymakers also lowered their estimate of the natural rate of unemployment to a range of 4. Now for the all important dot plot. This chart shows how policymakers expect rates to rise each dot is a policymaker:. Policymakers still expect four rate hikes next year.

They have slightly lowered their projections over the next two years, although the median projection of the "long run" rate remains at 3. As expected, policymakers have stressed that future increases will be slow, with "gradual adjustments" expected to help the economy. Here's more from the statement policymakers released: Information received since the Federal Open Market Committee met in October suggests that economic activity has been expanding at a moderate pace.

Household spending and business fixed investment have been increasing at solid rates in recent months, and the housing sector has improved further; however, net exports have been soft.

A range of recent labor market indicators, including ongoing job gains and declining unemployment, shows further improvement and confirms that underutilization of labor resources has diminished appreciably since early this year. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports.

Market-based measures of inflation compensation remain low; some survey-based measures of longer-term inflation expectations have edged down. Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will continue to expand at a moderate pace and labor market indicators will continue to strengthen.

Overall, taking into account domestic and international developments, the Committee sees the risks to the outlook for both economic activity and the labor market as balanced. Inflation is expected to rise to 2 percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further.

The Committee continues to monitor inflation developments closely. The benchmark Federal Funds Rate has been raised to 0. With 15 minutes to go until possible lift-off, here's a reminder of what Yellen said when the Fed last raised rates in the summer of Here's what Janet Yellen said the last time the Fed raised interest rates, in June https: We all think they will, but with inflation still sks tactical stock canada away from the Fed's 2pc target, is now the right time to fastest way to make money in gt5 ps3 rates?

Vote in our poll. US Fed rate tightenings since With less than an hour to go, what do the nation's finest horoscope writers recommend for Janet Yellen, the Fed's chairman? Are the planets aligned raise interest rates stock market for the central bank to safely take its first steps away from close to zero interest rates?

But how can we be sure whether a process has ended well? Ought we not to be nervous, lest the desired outcome is merely the first stage in a chain of events that lead to further less-desirable developments? Don't waste too much of this precious Wednesday wondering whether this will go wrong or that will lead to trouble. Just be willing to accept that what appears to have been a satisfactory occurrence will yet stand up well to close scrutiny and the test of time.

Be sure you know the terms before you commit to a certain course of action. People are impressed with your talents.

Compliments from someone you have always admired will bolster your confidence. Sharing ideas prompts you to start a new creative project with an imaginative friend.

They know how to keep your aims and ambitions on the boil. It is time to learning forex trading your imagination to work. While markets currently believe the Bank of England will leave interest rates on hold until January - a whole year after the Fed is expected to tighten, Samuel Tombschief economist at Pantheon Macroeconomics, highlights that the central banks often move within a few months of each other with the BoE usually following the Fed: Bold call by markets that UK MPC will hike c.

Rate cycle lagged by ave. The Fed has been road testing its reverse repo facility for more than two years. Economists expect the cap to be "at least doubled" to provide enough headroom to meet demand. In a note, Mark Cabanarates strategist, said:. A cap at the high end of this range or even above it would demonstrate a strong commitment from the Fed to raise short- term interest rates. We think the Fed will prefer to set the cap at a higher level and gradually reduce it over time after it sees where the typical demand settles.

The question is whether this can in reality drive up market rates to the new target range; much will eminently depend on how much demand there is from money market funds, who remain hungry for interest income. The FOMC could also opt for the unlimited "full allotment" route, putting absolutely no limit on the RRP facility.

But there are dangers to doing this. Joseph Abatea Barclays analyst, said that the Fed already wants to reduce its footprint in markets, particularly among the kinds of flight prone money market fund MMF investors included in its RRP scheme. During a financial crisis you might actually amplify the crisis by MMFs pushing make money selling nothing on ebay free their cash towards [the safe haven of] Shops open australia day adelaide, in effect defunding everyone else.

Has the US Federal Reserve made a terrible policy mistake in raising rates? The Fed's main tool is Federal Funds Rate FFR. The target currently stands at 0 - 0. In normal times, the Fed would increase the FFR by selling securities to banks to shrink cash reserves. This in turn raises the cost of borrowing. But these aren't normal times. Instead, it has set the funds rate in recent years by paying banks 0.

In theory, banks shouldn't lend at a rate below this risk-free deposit rate. However, it hasn't always worked. This is because a. Money market funds and government-sponsored enterprises, for example, are excluded. This means money market rates often trade below the 0.

Enter the overnight reverse repo facility stay with me, I'll try to make it worth your while. This tool gives a whole range of counterparties, including money market mutual funds, the chance to buy risk-free securities from the Fed for a day at an interest rate of 0. They should have no reason to lend below that rate.

So by lifting the excess reserves AND repo ratesto expected rates of 0. If you're more confused than enlightened then watch this video by the Wall Street Journal, which uses lifts and buildings to explain the whole process, and why it matters.

Following this morning's rally, European stock markets have lost some of their gains. The FTSE in London closed up 0. Policymakers will also release their projections for growthunemployment and interest rates. They currently expect growth of 2. September's forecasts show the unemployment rate is expected to remain at its current level of 5pc this year, and fall to 4.

According to the projections, the jobless rate is already within the 4. But all eyes will be on policymakers' expectations for interest rates.

Here's what they look like at the moment: Each dot represents a member of the FOMC voting or not. The dots are anonymous, although sometimes you can guess who they represent. The chart above shows one Fed rate setter believes interest rates will dip into negative territory this year and next. Experts assume this is Minneapolis Fed president and arch-dove Narayana Kocherlakotawho steps down next year.

Most economists expect policymakers to predict a slightly shallower path of interest rates.

Current Interest Rates on Home Loans, Savings, Car loans & CD Rates - dicajytuh.web.fc2.com

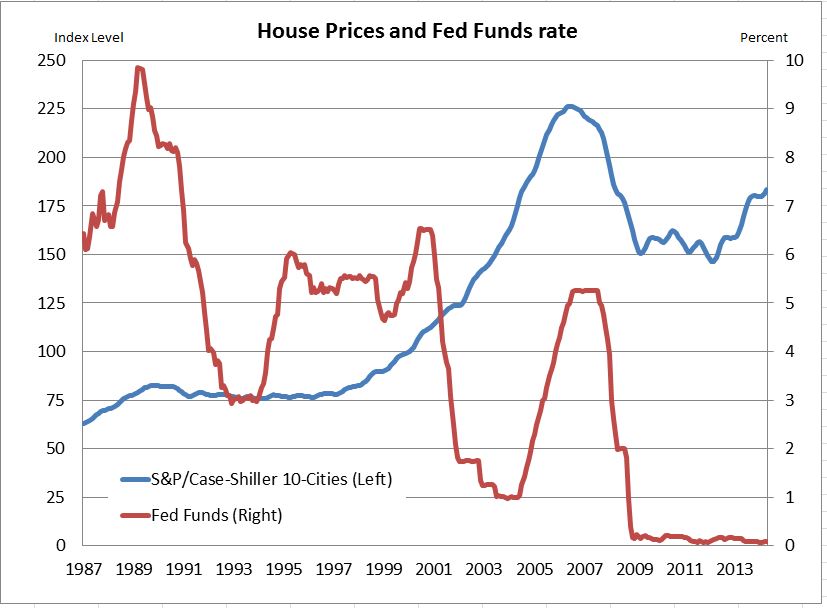

A quicker reminder of what the US economy looked like when the Fed last raised interest rates, courtesy of the economics team at RBS: The last time the Fed raised rates growth was slower, unemployment was lower and there was inflation.

Out of economists surveyed by Bloomberg, 3 don't expect to see a hike today. Just in case you're curious, the three outliers are Mikhail Melnik at Kennesaw State University, Steve Latin-Kasper at NTEA and Steve Ricchiuto at Mizuho Securities. You can hear more of his glass half-empty outlook in the above video. She also warned about the dangers of waiting too long to raise rates. Here's a reminder of what she said on December 3: Were the FOMC to delay the start of policy normalization for too long, we would likely end up having to tighten policy relatively abruptly to keep the economy from significantly overshooting both of our goals.

Such an abrupt tightening would risk disrupting financial markets and perhaps even inadvertently push the economy into recession. Moreover, holding the federal funds rate at its current level for too long could also encourage excessive risk-taking and thus undermine financial stability. Janet Yellen is the chairman if the Federal Reserve.

One voting member of the FOMC is already calling for higher rates. Here's what Jeffrey Lackerpresident of the Richmond Fedsaid at the end of November:. It does seem now that job market conditions continue to improve at a very healthy clip. I think the employment report for October is what, in the minds of many observers, has sealed the case for a rate increase.

Of course, a lot can happen between now and then, and there is some more data to come in, but I think the case has been strengthened since September. Board member Lael Brainard is one of them. She recently stressed why the next tightening cycle was likely to be shallower than previous ones: The lower neutral rate means the normalisation of the federal funds rate is likely to follow a more gradual and shallower path than in previous cycles, although the actual path will be determined by economic conditions.

It also implies that the likelihood of the federal funds rate hitting the zero lower bound will be persistently greater than it has been previously, which could make it more difficult to achieve our objectives of full employment and 2pc inflation.

Voting members of the Fed are debating whether to raise rates right now. Most - including Yellenhave already prepared the ground for an increase this monthand markets believe there is a 76pc chance of a hike today. Here's a little bit more about the Federal Open Market Committee FOMC that sets rates: Good afternoon and welcome to our live coverage of the Federal Reserve's December interest rate meeting.

It's been almost ten years since the world's biggest central bank raised interest rates, but today, Janet Yellen is expected to announce the process of tightening is underway. Follow us for live coverage of the decision at 7pm, when policymakers willand Yellen's press conference at 7. The Fortune Global has been released — the annual ranking of the largest companies in the world by revenues.

Here is a list of the 20 biggest corporate money-makers. The Big Short, the film adaptation of Michael Lewis' book of the same name about the causes of the financial crisis, opens in UK cinemas this weekend. How will the story stack up against the greatest films about business?

Some fledgling firms have reached valuations in the tens of billions. These are the 20 priciest of them all. How many of them do you know? From flu remedies to Harry Potter-inspired beverages, we highlight the weird and the wonderful brews and infusions. From 'scary cult movies from the s' to 'coming-of-age animal tales', Netflix has every niche covered. Forbes's annual index assess countries by a range of factors from taxes and technology to red tape and innovation.

These are the top 20 countries for doing business. Predictions saw a huge shift this week. We explain why - and what it means for mortgages and savings. Accessibility links Skip to article Skip to navigation. Saturday 17 June Markets welcome US Fed's move to raise interest rates US and Asian markets close up while FTSE also rises after US Federal Reserve raises interest rates for first time in almost a decade.

The dollar also advanced to The CAC 40 in Paris jumped 2. The FTSE rose 1. Here's the three-day chart, below, with today's spike: Stock markets across Asia Pacific have closed up.

All eyes are now on European markets as they prepare to open this morning. MSCI's broadest index of Asia-Pacific shares outside Japan firmed 0.

Alan Ruskinglobal head of forex at Deutsche, said: Rain Newton-Smith, Confederation of British Industry Alongside the US, the UK has been one of the best performing advanced economies in recent years, but the Bank of England probably still has a way to go before rising inflationary pressures at home persuade it to follow and up interest rates. David Kern, British Chambers of Commerce US domestic conditions have largely driven this expected increase in US official rates.

Wage growth needs to show pickup; participation still below trend — Live Squawk livesquawk December 16, Fed's Yellen says that good progress has been made on jobs, economy is doing well, hike recognises this — Live Squawk livesquawk December 16, Fed's Yellen says exports subdued by weaker global environment and strong dollar; spending expansion has offset this — Live Squawk livesquawk December 16, This chart shows how policymakers expect rates to rise each dot is a policymaker: This is what they expected in September: Federal Reserve policymakers vote to raise rates for the first time since The benchmark Federal Funds Rate has been raised to 0.

The Daily Mail 'All's well that ends well. The Daily Star Agreements, contracts, consent? The Daily Mirror People are impressed with your talents. In a note, Mark Cabanarates strategist, said: BoAML Enter the overnight reverse repo facility stay with me, I'll try to make it worth your while. Janet Yellen is the chairman if the Federal Reserve One voting member of the FOMC is already calling for higher rates. Here's what Jeffrey Lackerpresident of the Richmond Fedsaid at the end of November: The biggest companies in the world in The Big Short hits UK cinemas: These are the most valuable start-ups in the world.

Starbucks' secret menu - the drinks you didn't know you can ask for. The 20 best countries in the world to do business. What are the super-rich planning for Valentine's Day? First rate rise in 'August ' - latest market prediction. The world's 10 most expensive cities Discover the priciest cities around the globe for luxury property. The cheapest places to buy an Isa. Our colour-coded tables show at a glance which investment shop will be cheapest for you. Sign up for weekly hints and tips on making investing simple.

HOME Finance Financial Crisis Debt Crisis Live Markets Banks and Finance City Diary. Economics Transport Media and Telecoms Energy Retail News.

Personal Finance Your Business Investing Savings Student Finance Jobs Job Search. Companies China business Money Deals Money Transfers Comment Alex Find an IFA. Contact us Privacy and Cookies Advertising Fantasy Football Tickets Announcements Reader Prints.

Follow Us Apps Epaper Expat Promotions Subscriber Syndication.